In 2015 we continued our five-year streak of 200% annual growth. But our passion for life-changing person-to-person connections hasn’t changed since day one. Here are some of our favorite milestones – and stories – from the past year:

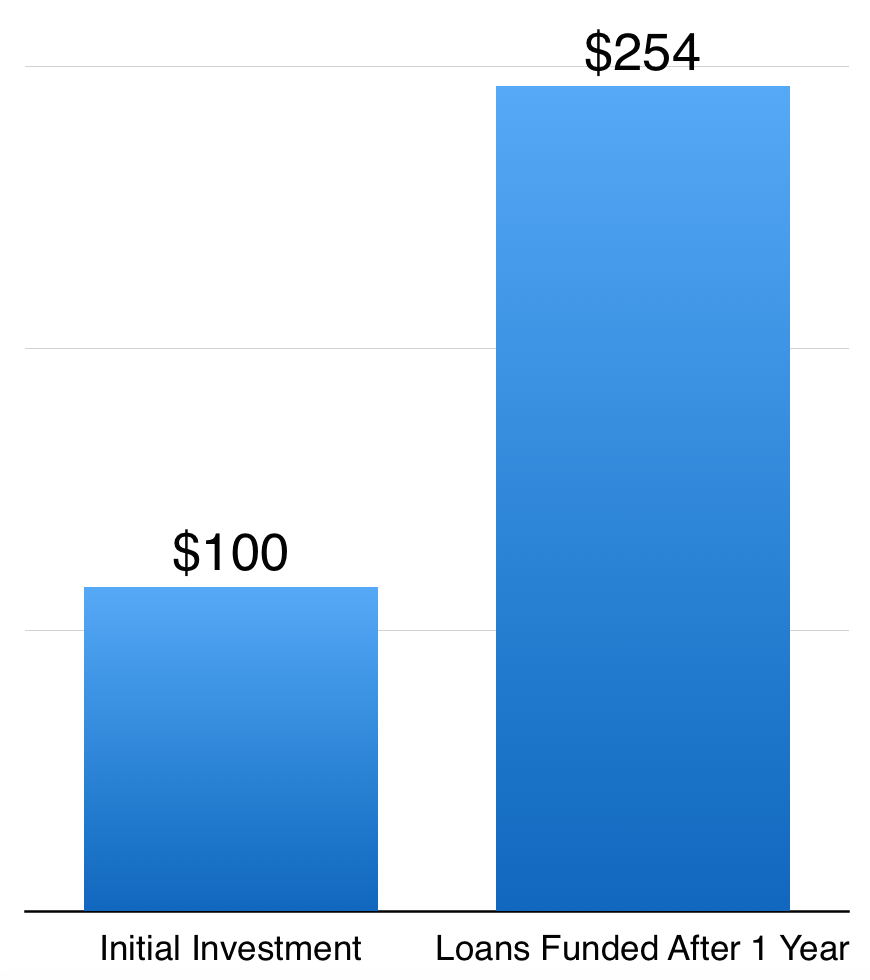

$100 uploaded in January funded an average of $254 worth of loans by the end of the year.

Thanks to recycling of repayments into new loans, the average investment into a Zidisha lending account finances over 2.5 times its value in loans per year. Talk about high-impact philanthropy!

Wairimu was one of the few young ladies from rural Kenya to be accepted into law school. $100 in seed funding from Zidisha lenders helped her start a maize selling business to pay for her tuition – and ultimately realize her dream of getting a law degree. Read her story here.

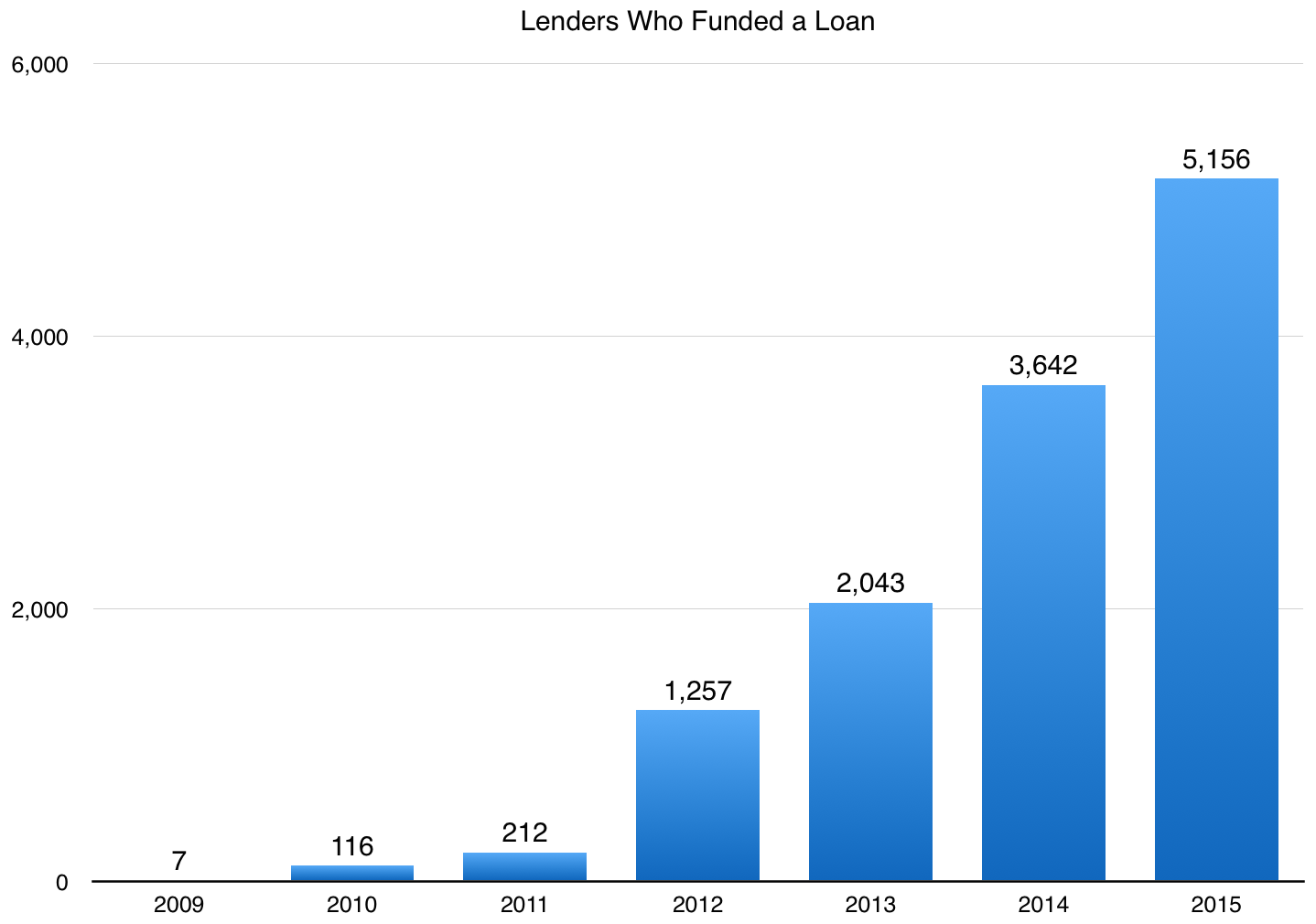

A record 5,156 lenders made loans in 2015.

5,156 people lent their own funds to Zidisha entrepreneurs during the year.

Edward spent his youth in an orphanage in Ghana, reading American business books and dreaming of becoming a social entrepreneur. Today, he’s teamed up with Zidisha lenders to open a much-needed pharmacy in his isolated community. Read his story here.

They came from 155 countries.

The top 10:

- United States

- United Kingdom

- Germany

- Canada

- Norway

- Australia

- India

- Netherlands

- Singapore

- Sweden

Violet hasn’t had many lucky breaks in her life. As a young child she worked as a hired hand alongside her mother to put food on the table. By age fifteen she was on her own in the city, sleeping in people’s kitchens and scrubbing clothes for a living. When Zidisha lenders finally gave Violet the chance to invest in her ideas, she turned $50 for vegetable seeds into a windfall profit. And when complications arose during the delivery of her baby, Violet’s new earning power gave her access to life-saving medical care. Read her story here.

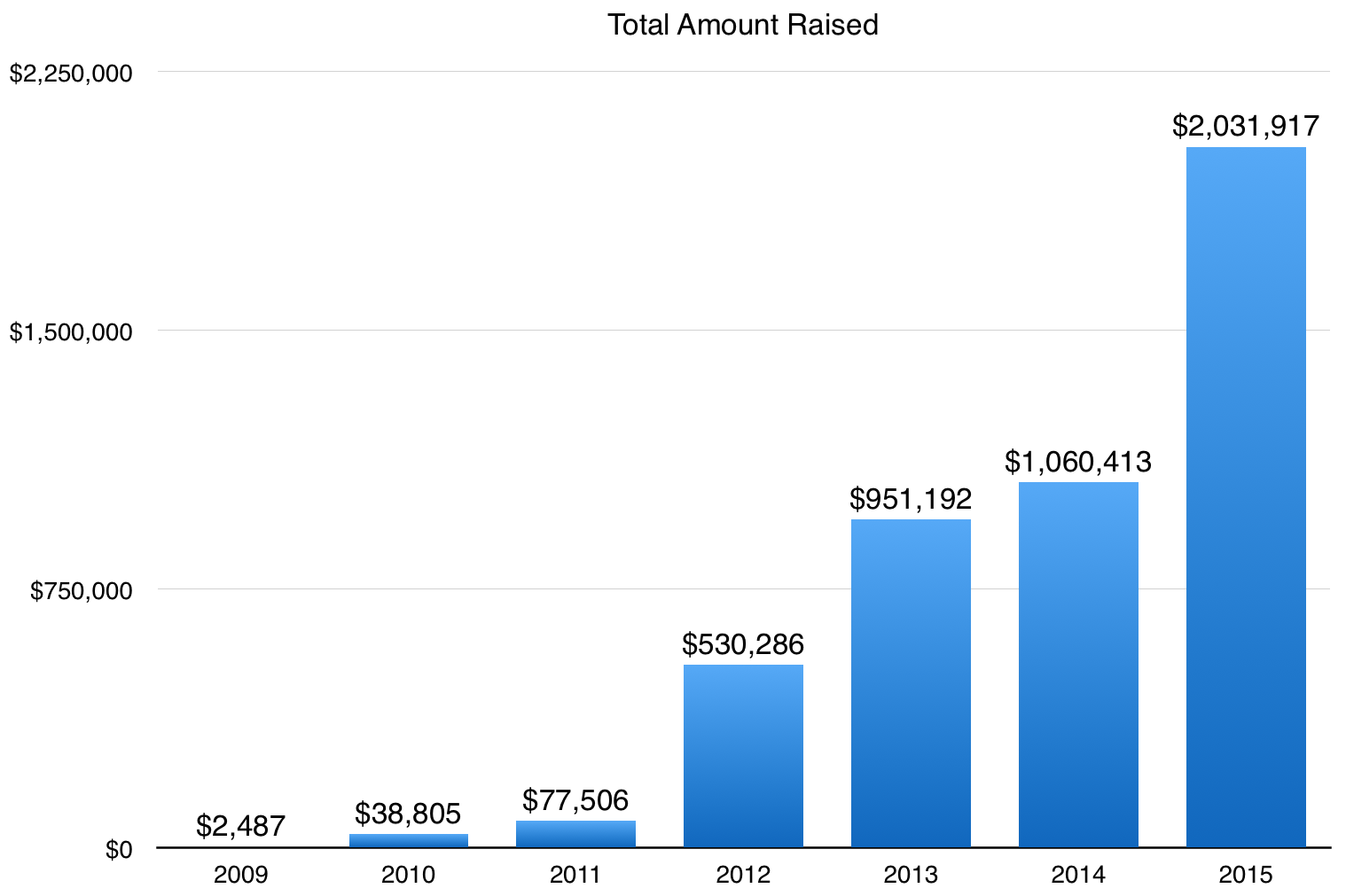

They lent over $2 million – up from $1 million in 2014.

Mardiana was determined to become the first producer of mushrooms in her community – but she lacked the money to leave her home island of Sulawesi, Indonesia for agricultural training. So she used the internet to learn the art of mushroom farming, then experimented to adapt it to Sulawesi’s unique climate. Today dozens of small farmers in Sulawesi are using the mushroom farming techniqus she pioneered. Read her story here.

Our lenders and borrowers posted 76,194 comments.

Borrower progress reports, lender notes of encouragement, sharing of family photos and favorite recipes… 2015 was a record year for cross-border dialogue.

It took Rebecca 2 years of saving to buy her first $135 camera. Now Zidisha lenders are turbo-charging her efforts to build a videography studio. Read her story here.

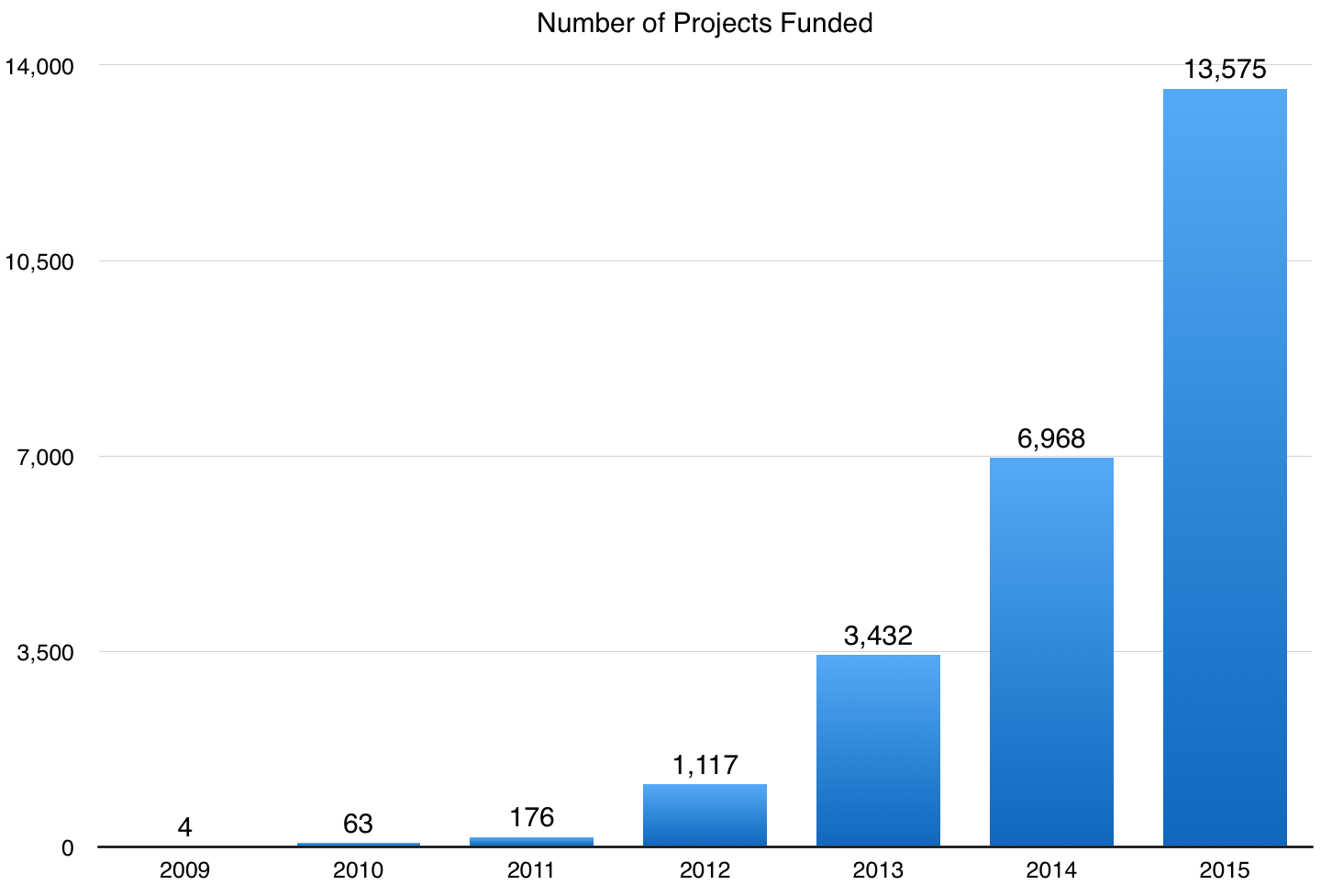

Together we funded 13,575 loan projects around the world.

More than double the number of loans raised in 2014!

Elizabeth wasn’t satisfied with the service jobs traditionally available to women in Kenya. So she launched her own business retailing mobile phones. Though demand was strong, banks wouldn’t give Elizabeth a loan for inventory. Zidisha lenders filled the gap. Read her story here.

2015 was our best year ever. Help us make 2016 even better! Make a loan today.

Happy to be part of you!