By Julia Kurnia

2016 was a record-breaking year in so many ways. Here are just a few of the highlights:

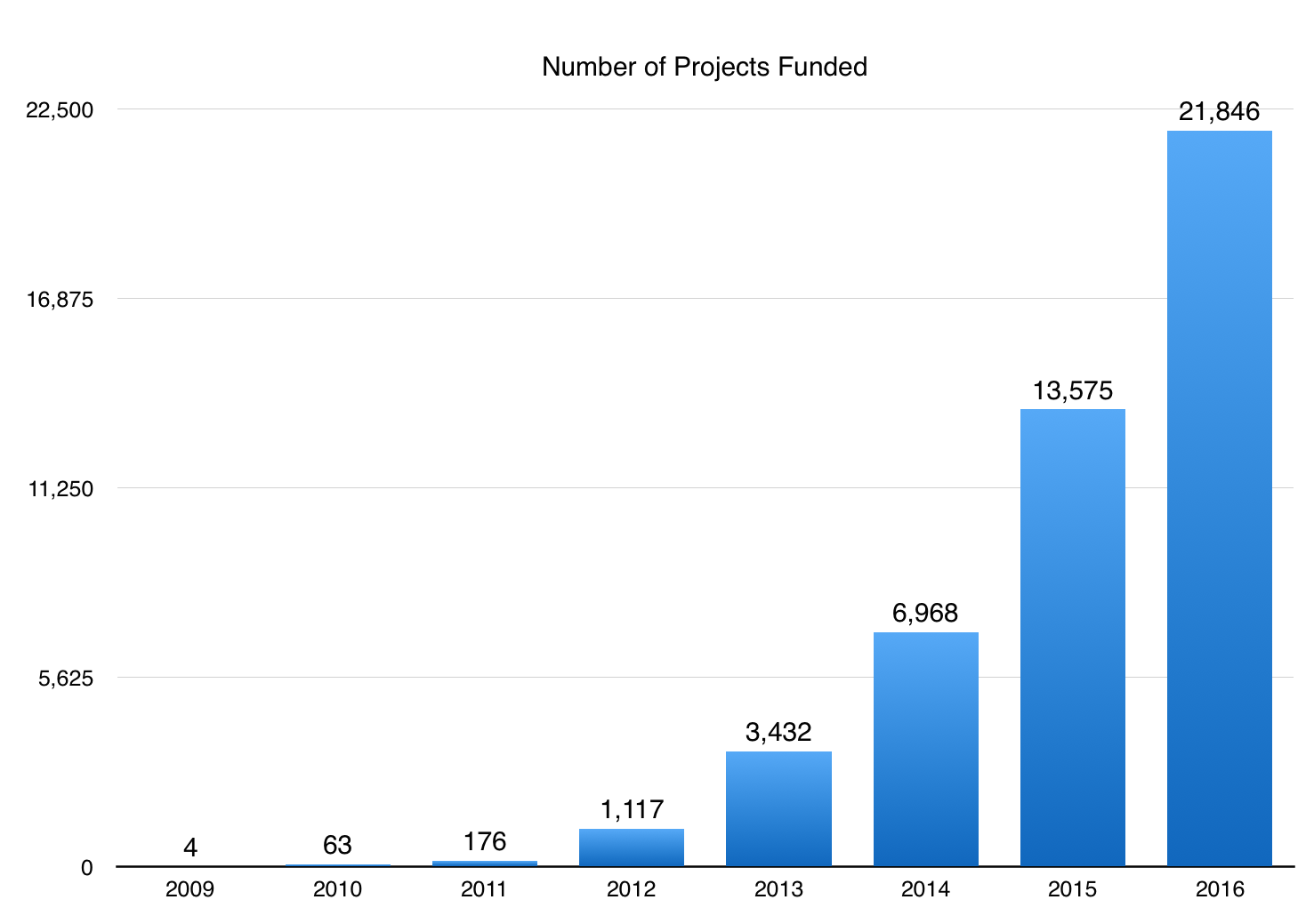

Number of loans funded: 21,846

Thanks to you, over 20,000 entrepreneurial dreams became a reality in 2016.

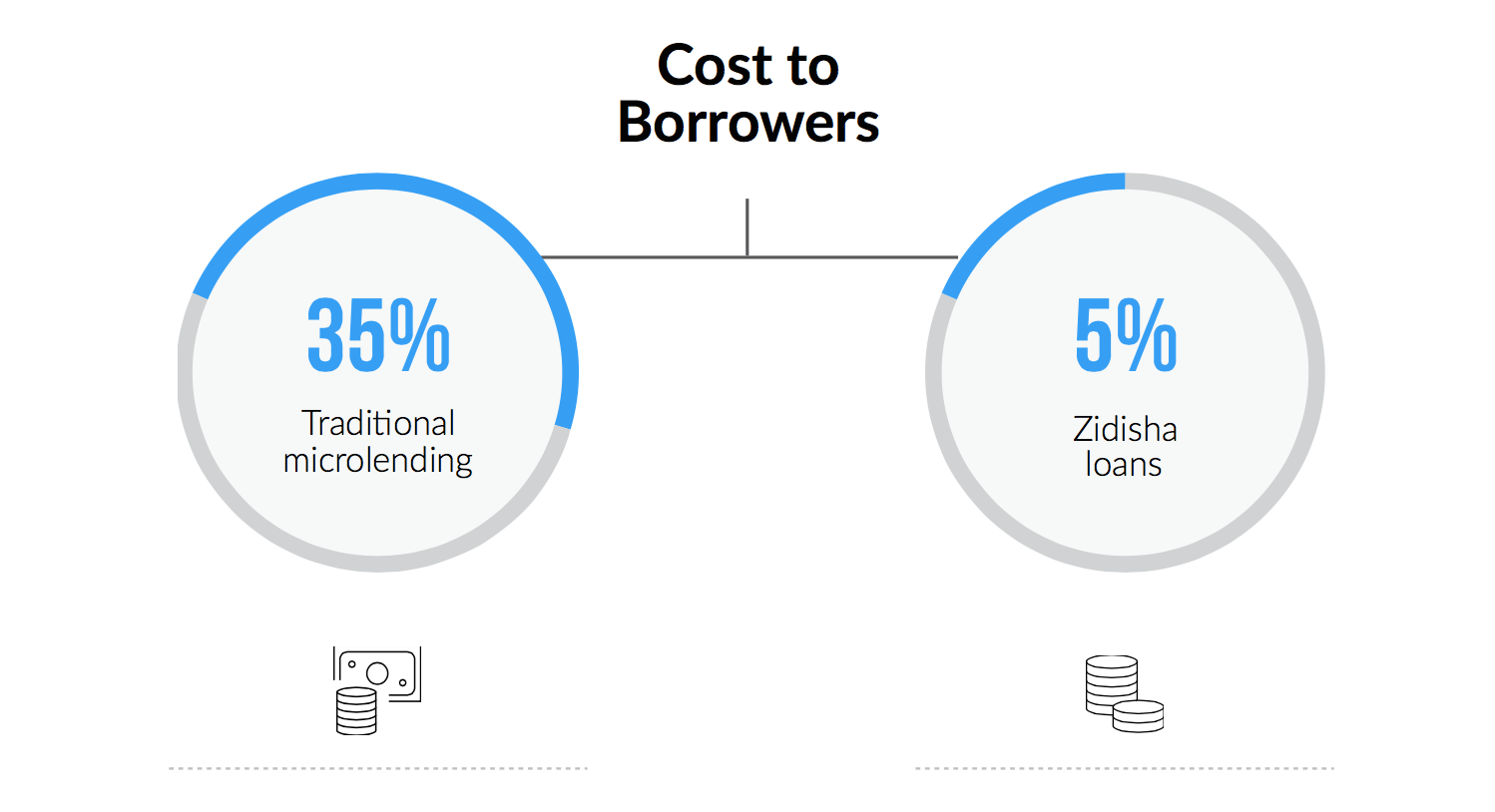

Our loan cost ratio: 4.95%

In an industry where loan cost ratios of over 30% are the norm, we spent less than 5% of the value of loans funded on overhead and operating costs, such as money transfer fees, web development services and salaries. Our lean web-based lending model means profits from the loans stay in the borrowers’ communities, rather than going to pay the lender’s overhead costs.

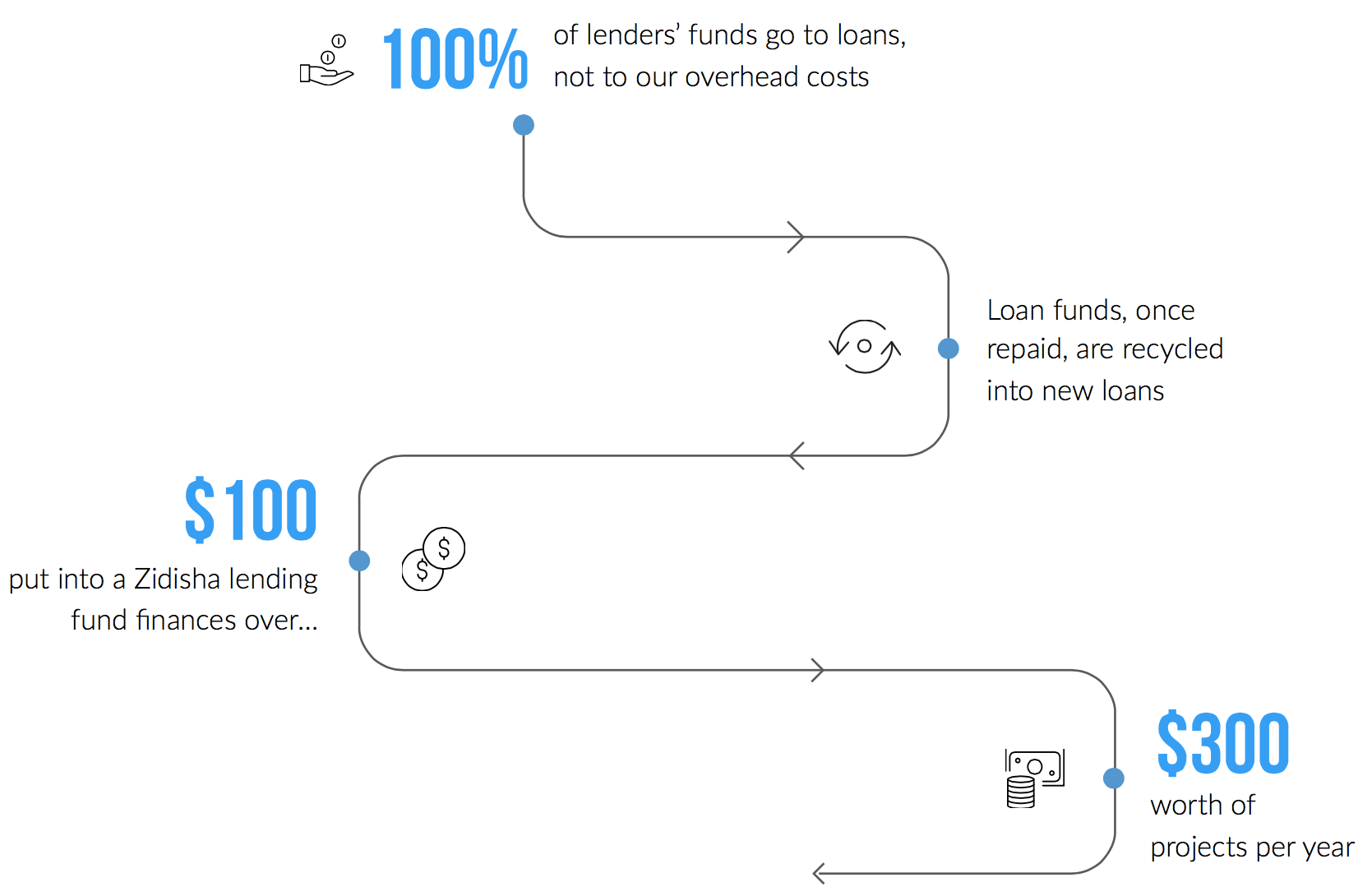

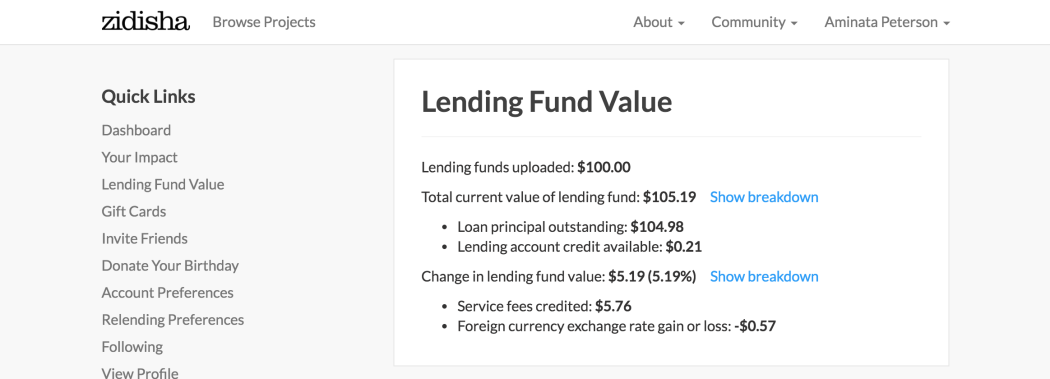

Loans funded with a $100 lending account: $300

Thanks to recycling of repayments into new loans, a Zidisha lending account funds many times its original value in loan projects.

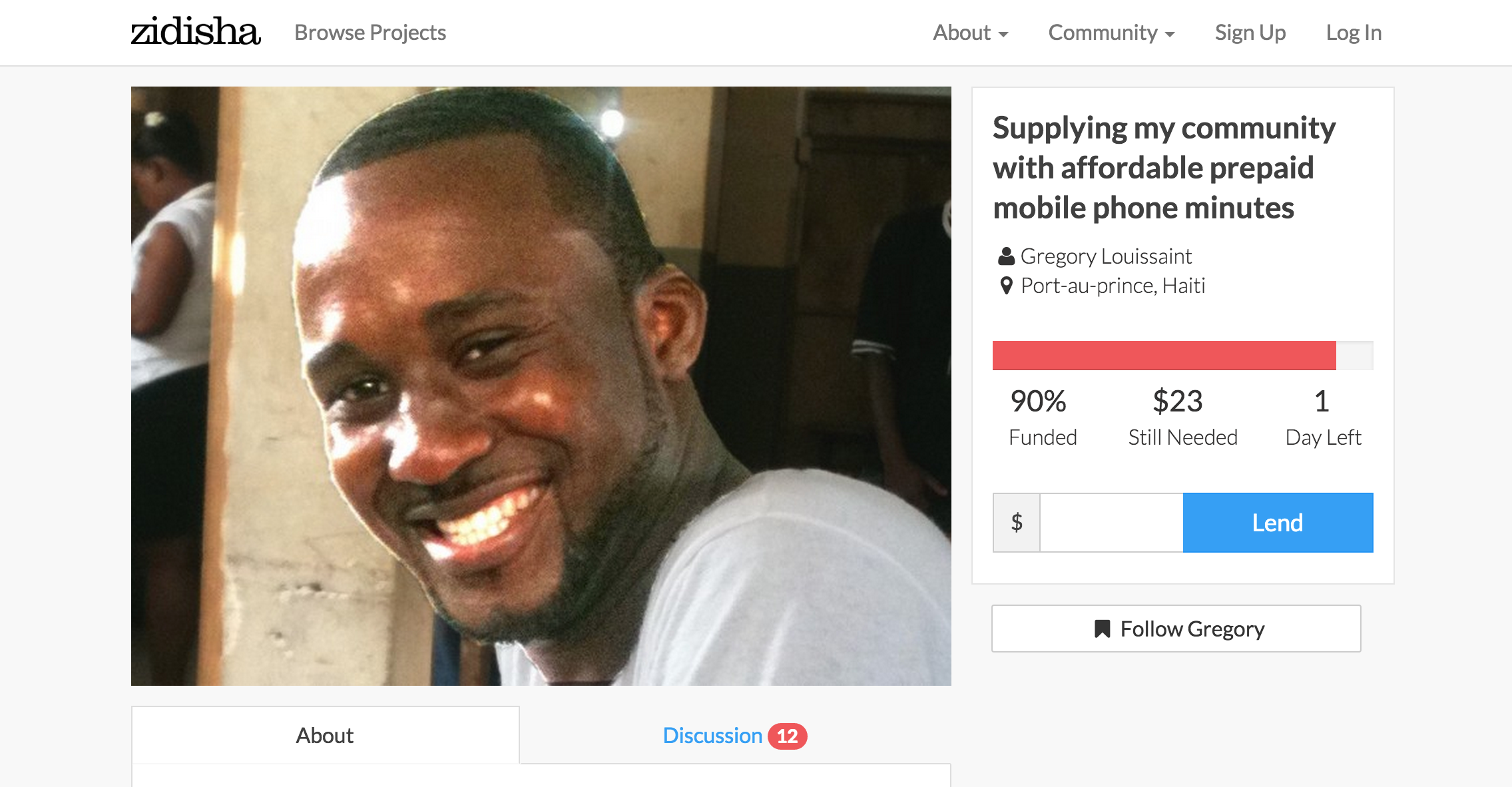

Contributions to loans in Haiti: 986

Zidisha lenders were among the most rapid sources of resources to help people in Haiti rebuild their livelihoods after Hurricane Matthew.

Number of borrowers who donated their time to coach new Zidisha members in their countries as Volunteer Mentors: 735

Volunteer Mentors are experienced, high-performing borrowers who mentor up to fifty new borrowers on how to successfully participate in the Zidisha community.

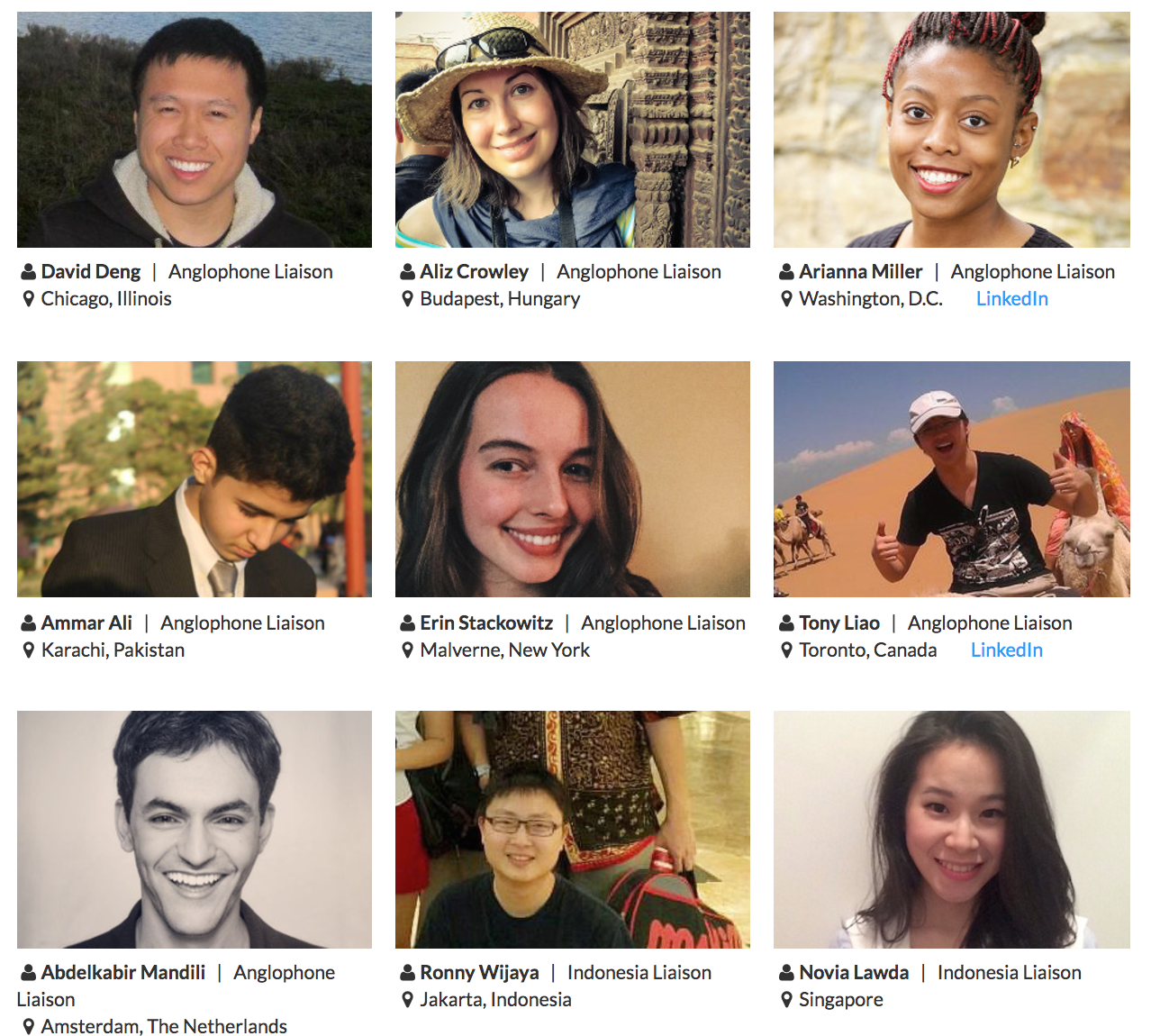

Volunteers from around the world: 132

Our internationally distributed volunteer team handled everything from processing loan disbursements to sharing our most inspiring entrepreneur stories in social media.

Number of Impact Investment Funds created: 238

We opened growth-enabled Impact Investment Funds to the public at the end of the year. Over 200 new funds have since been created!

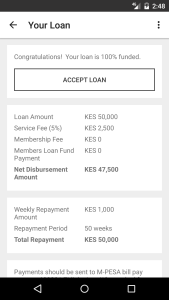

Installs of our new mobile app for borrowers: 4,988

We launched our first-ever mobile phone app in ten borrower countries in November, tapping into the recent spread of affordable smart phones in developing countries.

Entrepreneurs profiled in our new Instagram page: 25 (and counting!)

To celebrate the rich diversity and inspiring accomplishments of our community, we’ve just inaugurated an Instagram collection featuring entrepreneurs’ stories in their own words. (Follow it here.)

2016 has been our best year ever. Help us make 2017 even better! Make a loan to an entrepreneur today.