Our new Impact Investment Funds let anyone open a growth-enabled donation lending account.

Impact Investment Funds work just like regular lending accounts, in that 100% of the lending funds you upload, and their repayments, go to your chosen entrepreneurs. In addition:

- A portion of the 5% service fee paid by all Zidisha borrowers is reinvested in the account with every loan funded, so that its value can grow over time.

- Lending funds paid into the account are tax-deductible as charitable donations in the United States.

- Impact Investment accounts include a Lending Fund Value page, which tracks changes in the value of the fund and its outstanding loan portfolio.

Who should open an Impact Investment Fund?

Impact Investment Funds are intended for anyone who would like to make a charitable donation and watch its impact grow over time. (The average $50 lending account funds over $750 worth of loan projects in five years!)

Is this a financial asset?

No. All funds paid into an Impact Investment Account are considered charitable donations to be used only for funding loans, and cannot be withdrawn.

Why are withdrawals not enabled for Impact Investment Funds?

Since Zidisha is not an investment broker, US securities regulations do not allow us to offer revenue-generating financial investments to the public.

How are Zidisha’s costs covered, if it is returning service fee income to the Impact Investment Funds?

Our costs are covered separately by the portion of the 5% service fee not credited to the Impact Investment Funds, and by optional tips from lenders.

Why not reduce or eliminate the 5% borrower service fee, instead of crediting part of it to lending funds?

Our founding purpose is to reduce the cost of microloans in the world’s poorest places, where interest rates upwards of 40% are common. That said, we believe it is optimal for entrepreneurs to pay a modest cost for loans, because it helps prevent dependency on subsidized services, and encourages entrepreneurs to invest in revenue-generating projects. In addition, returning the service fee revenue to lending funds increases the capital available to other deserving entrepreneurs over the long term.

How much of the service fee is credited back to Impact Investment Funds?

Currently the full 5% service fee received for every loan (or portion of a loan) funded by an Impact Investment Fund is credited to the fund at the time the loan is disbursed. This may change in the future, depending on how large a percentage of loans are funded by Impact Investment Funds.

Are Impact Investment Funds guaranteed to grow over time?

No: Impact Investment Funds are subject to the same risks as other Zidisha lending accounts, including currency exchange rate fluctuations and non-payment by borrowers. Reinvesting service fee revenue is intended to help counterbalance these risks and make fund value growth possible, but does not guarantee it.

How do I open an Impact Investment Fund?

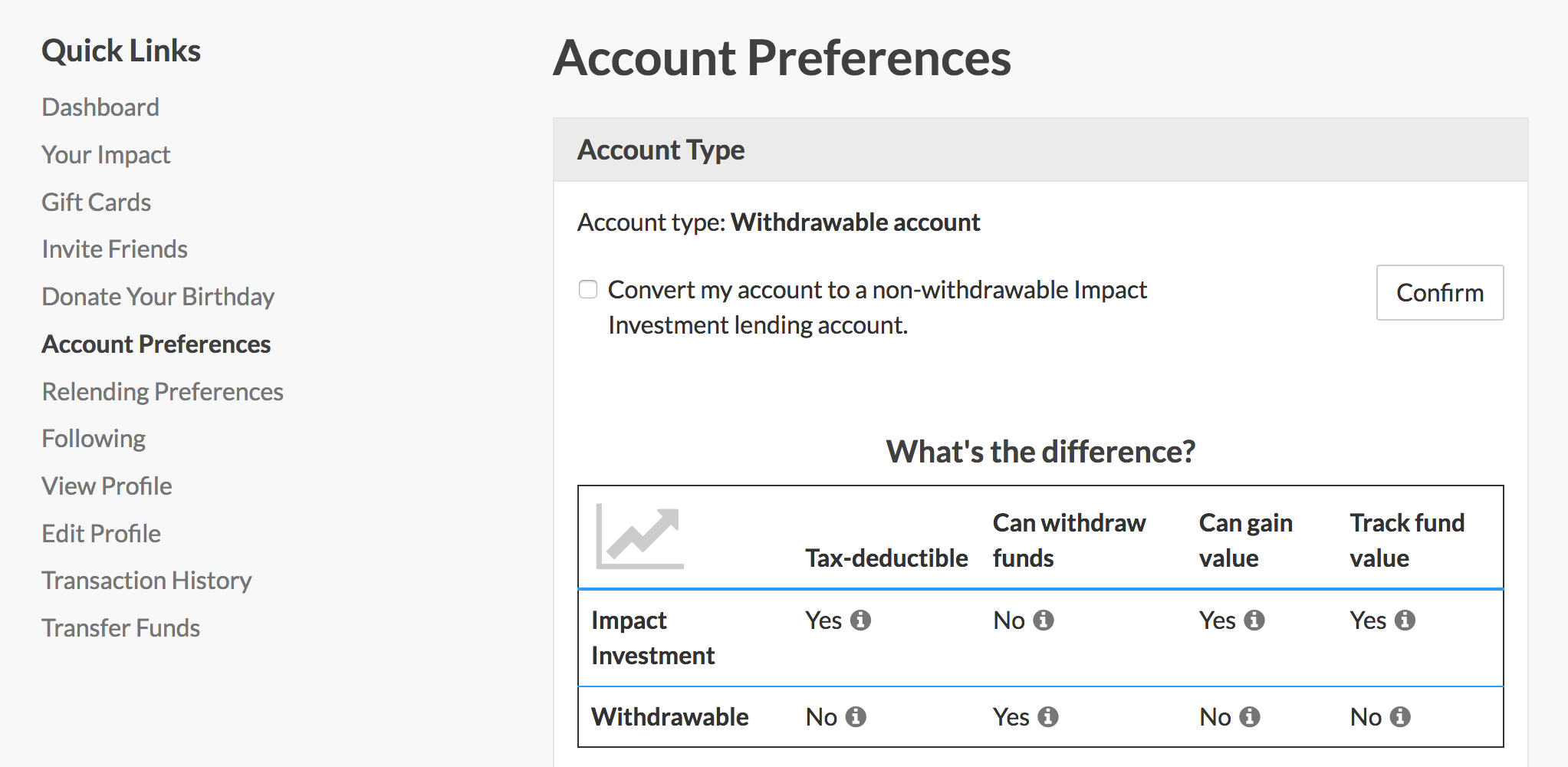

You may convert an existing withdrawable lending account to an Impact Investment Fund in the Account Preferences page.

To open a new Impact Investment Fund:

- Go to www.zidisha.org.

- Use the “Sign Up” link to create an account.

- Go to the Account Preferences page and choose the Impact Investment Fund option.

0 thoughts on “Introducing Impact Investment Funds”