By Julia Kurnia, Director

At Zidisha, we are pioneering something that has never before been tried: direct person-to-person lending across international borders, without any local bank intermediaries, loan officers, or brick-and-mortar offices. It’s a disruptive innovation that has dramatically reduced the cost of lending to the world’s most marginalized communities.

Web-based P2P microlending is so different from traditional staff-intensive microlending methods that developing it has involved a lot of trial and error. With no road map to follow, experience was the only way to know for sure what would work. Since founding Zidisha in 2009, we have continuously adjusted our lending model in response to actual user behavior.

This is a by no means exhaustive list of the changes we have made in the past year alone:

- Requiring loan applicants in most countries to link a unique Facebook account to verify their online identity and make it more difficult for third parties to create proxy accounts

- No longer requiring loan applicants to have a credit history with a local bank in order to join Zidisha, as this proved too difficult to reliably verify

- Enlisting the help of fellow borrowers to mentor new members and follow up on repayments, as many borrowers were keen to volunteer and play a larger role in the Zidisha community

- No longer contracting with local organizations to perform credit checks, as this was difficult to scale without opening the door to bribery

- Using an invite bonus program to encourage borrowers in good standing to invite trustworthy new members

- Relaxing admittance criteria (which had been too easy to game in practice), and reducing the size of first-time Zidisha loans to limit losses until a borrower has proved their reliability

- Establishing strict on-time repayment performance standards in order to progress to the next loan size

- Displaying on-time repayment scores on each loan page to encourage borrowers to keep this metric high

- Replacing recommendation forms signed by community leaders with SMS verification of loan applicant identities with family and neighbors

- Using machine learning to detect fraudulent applications

- Transitioning from monthly to weekly repayment schedules in most countries, as it proved easier for most borrowers to make small weekly payments than to save up bulk sums each month

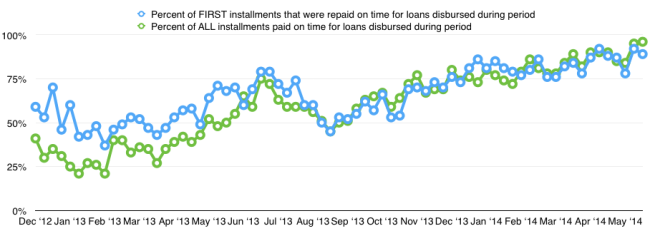

This graph tracks changes in on-time repayment rates at Zidisha since we initiated most of these changes:

- Since the timeliness of the first repayment installments correlates with the ultimate on-time repayment rate of Zidisha loans, we track that as an early indicator of changes in credit risk. This graph depicts the timely repayment of both first installments, and cumulative installments for all loans issued during the time period in the x axis.

- The graph does not track whether the installments were ultimately repaid, only whether they were repaid on time.

- “Repaid on time” is here defined as paid within ten days of the due date, within a threshold of $10 of the amount due.

You may view the loan data used to generate this graph here.

We estimate that the ultimate repayment rate for loans that were issued in early 2013 will be between 70% and 85%. (We do not know more precisely because many of them are still repaying.) Many lenders who funded loans at low interest rates during that period saw the value of their funds decline as unpaid loans were written off.

What is less obvious to our long-time observers is that credit risk at Zidisha has improved substantially over the past year. If the timeliness of the first repayment installments continue to predict the ultimate repayment likelihood of Zidisha loans, then the loans that are being issued today will have substantially higher repayment rates than those issued a year ago. If we assume that the ultimate repayment rate will improve in proportion to the timeliness of the first repayment installments, an ultimate repayment rate of between 85% and 95% would be a reasonable prediction. Thanks to this improvement, it is entirely possible that lenders who fund loans at modest interest rates today will be able to maintain or increase the value of their lending funds over time.

An interesting case in point is the Zidisha Matching Loan Fund. This $10,000 fund uses our automated lending tool to match, dollar for dollar, bids made manually by Zidisha lenders at the same interest rates originally bid by the manual lenders. It is therefore a reasonable proxy for the lending experience of a typical Zidisha lender.

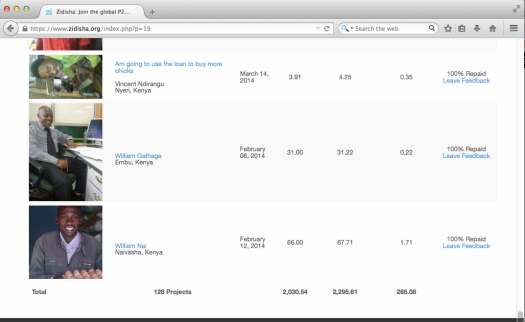

The Matching Loan Fund began lending in February 2014. Since then, the fund has distributed $15,253 to 568 different loan projects. (The amount distributed is more than the $10,000 put into the fund because repaid funds are recycled to new projects.)

Of those 568 loans, 128 have been repaid. In total $2,030 had been disbursed to those projects, and they repaid $2,295. Returns from interest plus currency fluctuations were $265, or 13% of the value of the amount disbursed.

The remainder of the loans are still outstanding. Of the $13,223 disbursed, $3,155 has been repaid, and $10,329 is principal outstanding – so the loan fund has gained a further $261 from interest and currency fluctuations realized thus far for the loans still outstanding.

In all, the fund has gained $526, or 5.2%, of the original $10,000, in the past four months. If current trends continue, the fund will gain more than 15% of its original value in interest net of currency fluctuations.

Net returns will almost certainly be lower than 15%, because some portion of the loans outstanding will likely be lost to borrower misfortune or default. Zidisha has not been around for long enough to predict losses with certainty. But if the overall repayment rate is above 85%, then gains are likely to exceed losses.

Zidisha is intended as a platform for philanthropy only. We do not recommend it as a commercial investment because the risks inherent in such a new lending model probably outweigh any possible financial return. It is certainly not a safe place to store assets one cannot afford to lose.

But it is reasonable to expect that the majority of lenders who fund a diversified selection of loan projects today will be able to maintain the value of their funds over time, so that they can continue to offer life-improving loans at affordable rates to many more deserving entrepreneurs. The resulting humanitarian impact makes Zidisha loans one of the best “investments” one can make.

Would you recommend this platform as a learning/participation tool for a high school Microfinance club?