The concept of microfinance is typically related to financial services provided to low income companies and individuals that do not have access to economic services, such as banks, credit cards and insurance companies and government sponsored enterprises. Although the idea of helping to ‘lift people out of poverty’ through microfinance has not been without its opponents, and for some microfinance is not always viewed as the only tool to end poverty.

Evidence that Microfinance Works

However, ‘silencing the critics’ is the phenomenal amount of ‘evidence’ that microfinance has a positive impact on the lives of those living in poverty. According to the Consultative Group to Assist the Poor (CGAP), comprehensive impact studies have demonstrated the following:

- Microfinance can help to give power to women and help promote gender equality by supporting women’s financial participation in the household.

- Microfinance enables low income households to meet basic needs and helps to protect them against risks.

- Poor households assisted with microfinance will have improved economic welfare and a greater stability of growth.

CPAG claims that: “Increased earnings from financial services lead to better nutrition and better living conditions, which translates into a lower incidence of illness. Increased earnings also mean that clients may seek out and pay for health care services when needed, rather than go without or wait until their health seriously deteriorates.”

Microfinance in Africa

Further proof that microfinance has a positive economic and social impact on the world’s poorest can be seen through the work of Martin Connell, an executive and philanthropist. During the early 1980’s Connell travelled to India, Bangladesh and Egypt, keen to promote economic and social development. Connell supported the idea of microfinance and making financial services available to diligent, yet poor, self-employed people in Africa and strived to make financial services readily available to these people. Whilst the main platform of microfinance had been relationship-based banking for small startups and individual entrepreneurs on a low income, Connell’s innovatory vision and approach to aiding development saw him create the first microfinance investment fund to buy shares in microfinance in Africa. The notion of buying shares in microfinance in Africa is typically regarded as being a group-based model of delivering financial services, whereby a handful of entrepreneurs collaborate and apply for loans and other financial services as a group. Shares in microfinance can be compared and bought on the internet and comparing and buying shares online is becoming increasingly popular. Investing in microfinance in Africa proved successful confirming that positive financial and social impacts could be produced by microfinance investment funds.

Empirical evidence

According to CGAP, empirical evidence has revealed that those living in poverty that had participated in microfinance schemes and who had access to financial services, such as banks, credit and loans, were able to improve their standard of living with a greater effect than those living without access to financial services.

CGAP uses several examples of empirical evidence to show how microfinance has helped to lift global poverty. In India, for example, half of SHARE clients have been lifted out of poverty. Whilst in El Salvador, the incomes of many involved in microfinance programmes have increased by as much as 145%. CGAP goes on to state that in Lombok in Indonesia, the typical wages of Bank Rakyat Indonesia borrowers has increased by 112%, lifting as many as 90% of households out of poverty. In Vietnam those participating in Save the Children condensed food scarcities from a total of three months to just one. Whilst in Ghana, 80% of poor people involved in Freedom from Hunger now had a secondary source of income, a stark improvement in the 50% of people enjoying second incomes who were not participating in Freedom from Hunger.

Microfinance empowering women

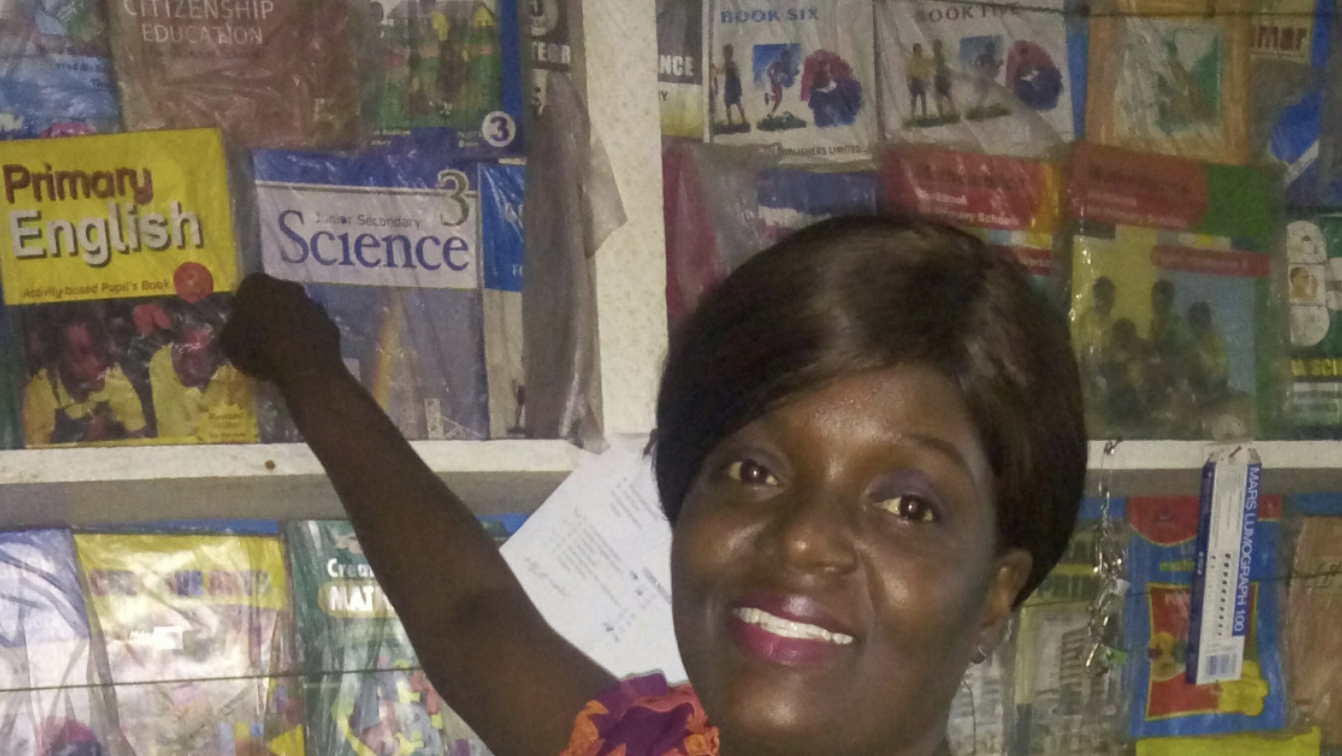

By making women in developing countries and who are living in poverty responsible for loans, repayments, providing insurance and maintaining savings accounts through women-based financial programmes, microfinance is playing a central role in empowering women. Studies have shown that having access to financial services and being involved in the upkeep and preservation of such services has improved the status of women within poor households and communities. As Rose Athieno, a produce reseller in Uganda states:

“Today I’m a very respected women in the community. I have come out of the crowd of women who are looked down upon. Due to the loan that I received…. You have made me to be a champion out of nobody.”

Guest post by: Eve Jamieson

This comment has been removed by a blog administrator.