by Rebecca Wolfe

Francis Maweu is always smiling, because, he says, he always finds something to smile about. A loving son, hard worker, and entrepreneur at heart, his passions have driven him all of his life. He started his first business as a young boy, raising and selling rabbits and chickens to supplement his mother’s breadwinning income in their small village in Eastern Kenya. His father passed away when he was quite young, and he has helped to support his mother and younger brother ever since. When Francis was nineteen he started a photography business, expanding to videography a year later. This is how he got his start in technology. In 2013 he relocated to Nairobi, where he was able to open a cyber cafe, providing internet access to his new community. These two enterprises paid Francis’ way through university, his hard work resulting in a Bachelor of Economics Degree from University of Kenya in December of 2015.

Still a college student at the beginning of 2015,Francis wanted to boost his business, but found himself unable to put forth the necessary capital. This is when Francis found out about Zidisha. Invited by friend and fellow entrepreneur Earnest Makau, Francis joined Zidisha and posted his first loan proposal in January of 2015. The $100 loan was quickly funded, and allowed Francis to purchase a new computer for his cafe. Just as he had hoped, business increased, and his income rose “tremendously.” Zidisha had helped to turn the tides of business in his favor. In February, Francis became a volunteer mentor for other Zidisha members, sharing his business expertise.

As his income increased, Francis was able to realize one of his dreams: opening a computer college. Now, in addition internet access, he was also able to offer classes in computer skills and digital literacy. By April of 2015, Francis’ college already had fifteen students enrolled, and a growing list of prospective learners who wanted to enroll but, due to limited space, could not be accommodated. Francis, then, was confronted with one of the best problems an entrepreneur can have: too much business. So, with his previous loan fully repaid, Francis came again to Zidisha lenders with a request. His second loan proposal, at a total of $427, was quickly funded, and, combined with the $450 Francis had already managed to save, he was able to purchase new computers and furniture for his students. He was even able to hire an employee to teach classes and look after the shop when he is gone.

In September of 2015 Francis was able to purchase a cooler to stock drinks for his customers, allowing them to enjoy a cold drink while they used the computers. The resultant boost in income from drink sales allowed Francis to increase his loan repayments. “I am doing good in business,” he said on his discussion page, “and thus would like to pay higher installments for others to benefit too.” He did this several times over the next few months, increasing his loan repayments when business boomed, allowing lenders to relend the funds that he repaid, increasing the impact of their investment.

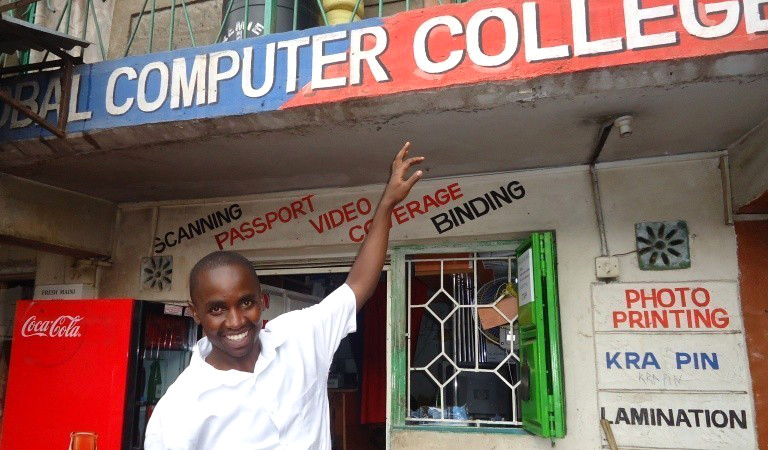

At the beginning of 2016 a new partnership with a nearby secondary school was flooding Francis’ shop with students eager to learn basic computer skills and gain digital literacy for the workplace. Francis’ Global Computer College was taking off. Along with a rise in popularity of online sports betting in Kenya making the cyber cafe a popular place, Francis again found himself facing the best kind of problem: too much business. Even after extending the hours of his shop, often staying open until 10 PM, Francis was unable to keep up with the needs of his customers. He began to seek out ways to increase the capacity of his cafe. He came up with plenty of ideas, but all of the necessary upgrades required large amounts of starting capital that he did not have. Francis, though, was not alone in his business ventures. He had a family of lenders and advisors on his team.

In February Francis reached out to Zidisha, requesting a loan of $765 to purchase more computers. With an upgrade in his offerings, he was sure that he would see business take off even more. “I am really happy as I see my dreams being converted to realities,” he said. Business did boom, taking off enormously over the next seven months. Between February and September, Francis was able to open an mpesa (mobile money transfer) shop, an Aritel money agency, and purchase a larger refrigerator for a greater selection of beverages for his customers. “I am so grateful to Zidisha for the light, hope, and success it has brought in my business since joining it. I dearly appreciate the community,” Francis posted to his discussion page, along with photos of his new ventures. A month later, at the beginning of October, Francis brought forward a new proposal. He wanted to expand his Global Computer College’s class offerings to include photography and videography, in which he had long been a practicing professional himself.

With a new venture in mind, Francis came to Zidisha with a well organized plan. His loan proposal spoke of diversifying his portfolio, upgrading to professional cameras, both still and video. “This will enable me to employ more people and take advantage of the changing lifestyle of Kenyans,” he said. With professional-grade equipment, he could cover events such as weddings and birthday parties, as well as teach and train others in the art. It was not long before this loan, too, was funded. The $1290 funded by Zidisha lenders, combined with the $800 Francis had managed to save, allowed him to purchase two professional cameras and a tripod. Francis has now added video and photo classes to his college’s repertoire, and is able to cover events as a photographer and videographer himself.

Francis has demonstrated an incredible mind for business and entrepreneurship, as well as a huge desire to help his community through training and employment. Currently, Francis is a volunteer mentor for almost fifty borrowers in his community, many of whom come to his cyber cafe to access their Zidisha accounts. The future, for Francis, is a bright one and digital one, and Zidisha will be with him in it, helping him make a difference for his neighbors and his family back home.

If you would like to help another entrepreneur reach their goals and impact their community, head on over to our loans page and contribute to a loan proposal.