By Julia Kurnia

At Zidisha, we have invested a great deal in the development of reputation measures – feedback ratings, and on-time repayment scores – for borrowing members. Most of our website development resources have gone toward risk management and in developing tools to allow lenders to better differentiate loan applicants on the basis of previous performance and trust networks. These investments are paying off in the form of the first exclusively online microlending community to connect lenders and borrowers directly across international borders on the basis of online reputation alone.

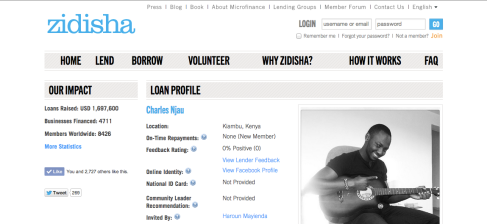

As a first step toward a greater emphasis on the contributions of lenders to our community, we introduced today a karma display for lenders. This is shown in parentheses next to lender usernames in the borrower profile pages, and is analogous to borrower on-time repayment and feedback scores in that it is intended to say something about the impact of the member’s contributions to the Zidisha community over time.

Currently, karma is calculated on the basis of five factors:

- The total amount lent by the lenders the member has invited to join Zidisha via the “Send Invite” page

- The total amount lent by lenders to whom the member has given gift cards

- The total amount lent by the member

- The total number of comments posted by the member

The karma score is a work in progress, and we expect to adjust and improve it with time and experience. Thus far, the largest karma scores appear to be held by members who have been the most active in inviting others to join, via email invites and gift cards, and who have posted many comments.

I look forward to questions and comments regarding lender karma, and would especially welcome your feedback regarding the factors that ought to carry the most weight in calculating karma.