By Betsy Ramser Jaime

‘My name is Stephen Kimani, but my friends call me Steve. I was born in Kiambu County in the central highlands of Kenya twenty three years ago. I was born in a farming community where most people are involved in food farming as well as livestock keeping. My parents are such farmers and I spent my childhood years in our farm helping them in their farming activities.’

As a student, Steve completed his primary and secondary studies before pursuing a course in Electronics Maintenance, which trained him to become a qualified technician for mobile phone repair. However, he realized that this was not the right career fit for him as the work was very demanding with a low income.

Afterwards, Steve decided to make a transition, and he moved to Mombasa to live with a relative who owned a business selling motor vehicle parts. After gaining two years of experience working as a shop attendant, he decided that it was time for him to venture out, to start a business of his own.

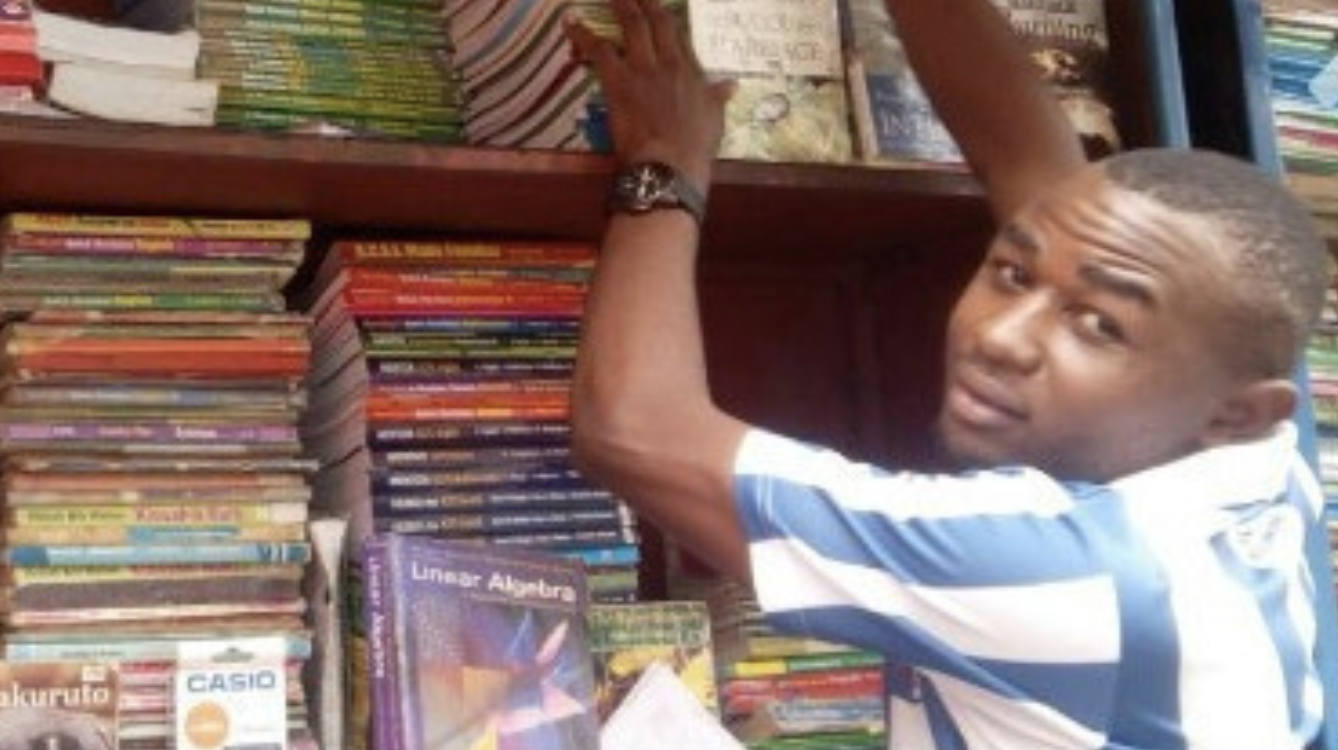

He started his own business selling second hand school books, and it worked out so well that he’s still doing it today several years later. He explains, ‘I deal with the selling of second hand school books. I normally get the old books from parents whose children graduate to the next classes. This is a common practice in Kenya where old books are passed on to those who are in lower classes instead of buying new books which are more expensive.’

If he happens to run out of old books, he also sells new books, but he finds that this is a rare occurrence. With a profit margin of 40%, he has a steady business. The major challenge for Steve is that there is a seasonal nature to his business, usually peaking at the beginning of a new school term in January, May, and September.

In his time with Zidisha, Steve has been able to successfully raise 5 Zidisha funded loans, dating back to April 2015, with a $100 start. He took his $100 loan and used it to purchase a new batch of second hand books to add to his current stock. He explains that dictionaries and atlases tend to be two of his biggest sellers. He says, ‘The expected return will help me grow my business at an even faster rate and bring my dream of moving into a better place even closer.’

Later that same year, he raised his second loan for $181 as a new term was starting. Since this is his best time of year for sales, he wanted to take advantage of this by increasing his stock. For this particular loan, he was able to purchase textbooks for both primary and secondary school levels.

For Steve, he knew that if he could increase his inventory, this would better position him to be a one stop shop for all textbook needs for students in his area.

By April 2016, Steve was ready for another loan, this time for $363, and he was excited to share with lenders, ‘My business is doing well. With ever growing demand for education, I have enjoyed a continuous flow of customers throughout the year. My bookstore is now bigger and my clients have increased tremendously. I intend to use the whole amount from this loan to get more copies of fast moving titles. This will increase my sales and profitability significantly.’

As Steve saw the outcome of lenders investments, he proudly shared, ‘Thank you Zidisha lenders for making things that seemed impossible a few months ago possible. With your credit, I have been able to grow my business to a level that I would have otherwise taken much longer to achieve. My books selling business is doing well and I hope to keep growing with more of your support.’

As 2017 rolled around, Steve was ready for two additional loans to grow his business. In April, he raised $575 and purchased a variety of new books for students doing their final exams from both primary and secondary school. He hoped that this income would propel him to a level where he could move to a permanent building from his current makeshift structure.

Then, in October 2017, Steve was able to raise his largest Zidisha funded loan, of $1,093. With 1/4 of the loan, he intended to add more stock to his business. Then, with the remaining 3/4 he hoped to lease another store and also hire another person to help with that location.

He shares, ‘Having the two shops, it will help increase my earnings and someone else in earning his/her living. I’m hoping to make more than half of the loan as profit within a period of one year.’

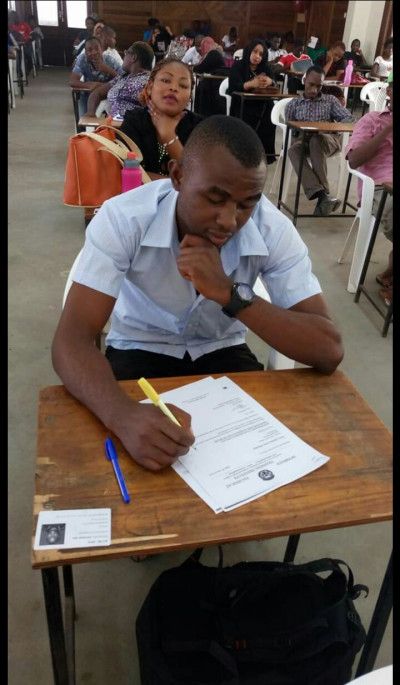

As of 2019, Steve is currently thriving in his business and is also back in school as he says, ‘Hello my dear lenders, I wish to thank you for your generosity. My previous loan came at the right time when mostly needed. I purchased books with some of the amount and used the rest in renting another store. This has helped me to employ another person whom his life has changed since then. This has increased my profit margin which has greatly helped me pay my college fee and advance my education. Below is my photo in class studying.’

Would you like to empower another student entrepreneur like Steve? Make sure to head on over to our Browse Projects Page to learn more!